Finance

Debits (DR)

Learning about Debits (abbreviated DR) and Credits (abbreviated CR) can be confusing. However, if you keep in mind that Debits increase Asset and Expense accounts and decrease Liabilities, Equity Accounts, and Revenue Accounts, you’ll be half way there to understanding Debits and Credits.

Read MoreHow to Make QuickBooks® More User-Friendly eBook – Available Now!

Just thought I’d post a quick message about my new eBook: How to Make QuickBooks® More User-Friendly, Simple changes to streamline your workflow in QuickBooks® Desktop. This eBook was derived from my video training course with the same title. It is approximately 50 pages with nearly 60 screen captures with step-by-step instructions. I cover the…

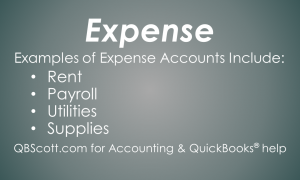

Read MoreExamples of Expenses

Expenses are what a company has incurred or used up and are shown on a Profit and Loss Report. Expenses can include Rent, Payroll, Utilities, and Supplies.

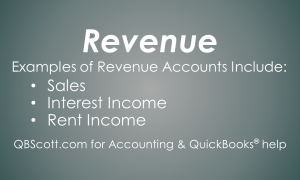

Read MoreExamples of Revenue

Revenue is what a company has earned and is shown on a Profit and Loss Report. Revenue can include Sales, Interest Income, and Rent Income.

Read MoreFebruary 2018 Update

It’s already March!! Just like January, I was pretty busy in February with a bunch of new projects. However, my wife and I took a much-needed vacation to Florida (Tampa, Lake Worth, and Naples). It was such a great experience, relaxing, and refreshing. Here’s what’s coming up: By the end of March How to make…

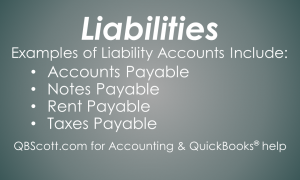

Read MoreExamples of Liabilities

Liabilities appear on a company’s Balance Sheet and are what the company owes. Liabilities can be Accounts Payable, Notes Payable, Payroll Payable, Rent Payable, Taxes Payable or any other payable.

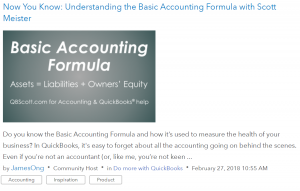

Read MoreBasic Accounting Formula collaborative post

A couple of weeks ago I posted about the Basic Accounting Formula here and James Ong, Host from the QB Community, contacted me about collaborating on a post for the QB Community. In case you didn’t know, the QB (QuickBooks) Community is a great online resource where you can learn about QuickBooks, Accounting, and Small Business. The…

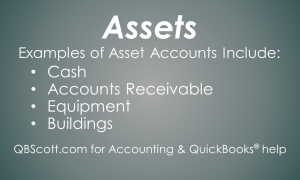

Read MoreExamples of Assets

Assets appear on a company’s Balance Sheet and are what the company owns. Assets can be Cash, Accounts Receivable, Equipment, Inventory, Land, Buildings, or even Intangible items.

Read MoreWhat is an Expense?

Expenses are what a company has incurred or used up. Expenses are shown on a Profit and Loss Report also known as an Income Statement.

Read MoreWhat is Revenue?

Revenue is what a company has earned. Sometimes this is referred to as Sales or Income. Revenue is shown on a Profit and Loss Report also known as an Income Statement.

Read More