Posts Tagged ‘Revenue’

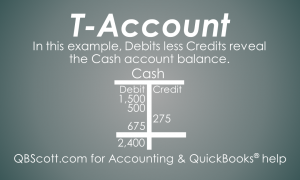

T-Account Example

For the image below, total Debits less total Credits equal the Account Balance. So, in the example in the image, total Debits of 2,675 less total Credits of 275 equal 2,400. This is a Debit amount since, in this example, Debits are greater than Credits.

Read MoreWhat T-Accounts do

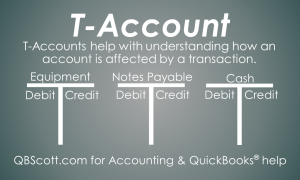

All Debits and Credits are tracked in an Account’s T-Account. When tracked properly, it’s easy to figure out the balance of an account.

Read MoreHow T-Accounts help

Each Account has it’s own T-Account. This allows proper transaction tracking of Debits and Credits.

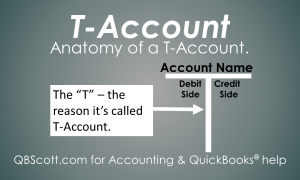

Read MoreAnatomy of a T-Account

A T-Account visually represents the impact transactions have on a particular account. As seen in the image, the white “T” allows space for an Account Name (at the top), Debit Side (Left), and Credit Side (Right). It’s a simple visual that helps when trying to understand the balance of an account.

Read MoreDebits = Credits

Debits must always equal Credits. On every transaction the total of the Debits must equal the total of the Credits. In some transactions you may have more than one Debit and only one Credit. Or you may have one Debit and more than one Credit. Regardless the total value of Debits must equal the total…

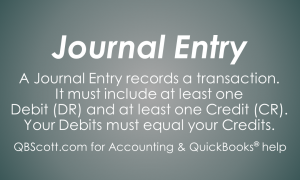

Read MoreWhat’s a Journal Entry?

The Journal Entry is used to record a transaction. It must include at least one Debit and least one Credit. The Debits and the Credits in the Journal Entry must equal. Journal Entries are used all throughout accounting.

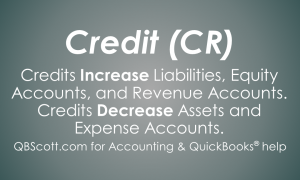

Read MoreCredits (CR)

Credits are the opposite of Debits. Credit increase Liabilities, Equity Accounts, and Revenue Accounts. They also decrease Assets and Expense Accounts.

Read MoreDebits (DR)

Learning about Debits (abbreviated DR) and Credits (abbreviated CR) can be confusing. However, if you keep in mind that Debits increase Asset and Expense accounts and decrease Liabilities, Equity Accounts, and Revenue Accounts, you’ll be half way there to understanding Debits and Credits.

Read MoreExamples of Expenses

Expenses are what a company has incurred or used up and are shown on a Profit and Loss Report. Expenses can include Rent, Payroll, Utilities, and Supplies.

Read MoreExamples of Revenue

Revenue is what a company has earned and is shown on a Profit and Loss Report. Revenue can include Sales, Interest Income, and Rent Income.

Read More