Finance

Normal Balance: Revenue

The normal balance of a Revenue Account is a Credit. So, if you earned $750 from selling widgets (Sales), it means you have a $750 Credit in the Sales account.

Read MoreNormal Balance: Owners’ Equity

Like Liability Accounts, the normal balance of an Owners’ Equity Account is a Credit. So, if you have $250 in Retained Earnings, it means you have a $250 Credit in the Retained Earnings account.

Read MoreApril 2018 Update

Tax season is over and there’s a sense of relief which is always welcome after busy season. Despite not preparing income tax returns, I’m still very active with helping clients prepare their info for tax prep. It’s nice to turn down the intensity level for a bit and focus on more projects. Here’s what’s coming…

Read MoreNormal Balance: Liabilities

The normal balance of a Liability Account is a Credit. So, if you owed $750 to someone in the form of a Notes Payable, it means you have a $750 Credit in the Notes Payable account.

Read MoreNormal Balance: Asset

The normal balance of an Asset Account is a Debit. So, if you had $1,000 in a bank account, it means you have a $1,000 Debit in the bank account.

Read MoreHow to Make QuickBooks® More User-Friendly Book

Just thought I’d share a little info about my book, How to Make QuickBooks® More User-Friendly: Simple changes to streamline your workflow in QuickBooks® Desktop. It’s available in eBook, Paperback, and Kindle format. See the description and video about the book below. Streamline your workflow in QuickBooks® with some simple, one-time changes. Follow along as…

Read MoreThree Tips to Help You Mind Your Business

Three Tips to Help You Mind Your Business As a small business owner, you need to have a pulse on #allthethings, meaning Human Resources, Marketing, Product/Service Development, and so many other topics… including Accounting. This post will help you Mind Your Business with my three best tips I see people like yourself struggling with every…

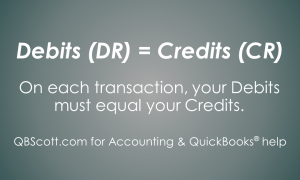

Read MoreDebits = Credits

Debits must always equal Credits. On every transaction the total of the Debits must equal the total of the Credits. In some transactions you may have more than one Debit and only one Credit. Or you may have one Debit and more than one Credit. Regardless the total value of Debits must equal the total…

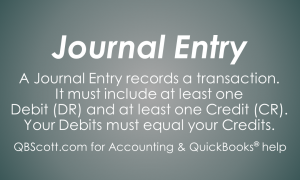

Read MoreWhat’s a Journal Entry?

The Journal Entry is used to record a transaction. It must include at least one Debit and least one Credit. The Debits and the Credits in the Journal Entry must equal. Journal Entries are used all throughout accounting.

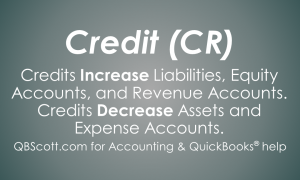

Read MoreCredits (CR)

Credits are the opposite of Debits. Credit increase Liabilities, Equity Accounts, and Revenue Accounts. They also decrease Assets and Expense Accounts.

Read More