Accounting

The Secret to a Successful Startup? Focus on Accurate Financial Records

Source: Entrepreneur | Repost QBScott 10/12/2022 – Studies show that many startups are not handling the financial side of business correctly. This is a big mistake that can hinder growth. You might not be very organized with your financial records during the beginning stage of your business or side hustle. Less than half of small…

Read MoreHow to Manage Accounting for Small Businesses

Source: Salesforce | Repost QBScott 8/18/2022 – Small business owners thrive when they have the time to focus on the core aspects of their business. This includes customer service, product innovation, and sales. Administrative tasks such as accounting are necessary, but often have to be prioritized after other duties. However, it’s important that entrepreneurs learn…

Read More5 Personal-Finance Mistakes That Kill Promising Companies

Source: Entrepreneur | Repost QBScott 5/21/2020 – For most people, personal-finance mistakes affect only themselves. For entrepreneurs, a personal-finance slip-up can have far-reaching consequences. People who get into tight financial spots while running their businesses must make difficult choices about which bills to pay, which opportunities to let go and which partners to leave. Founders…

Read MorePivoting Your Small Business Model to Survive the COVID-19 Crisis

Source: Worth Newsletter | Repost QBScott 5/7/2020 – There is opportunity in every crisis, and the COVID-19 pandemic has created a crisis for many small business owners that is unlike any other before. The coronavirus has forced governments into enacting what some are calling “the Great Lockdown.” The lockdown consists of closing all non-essential businesses,…

Read More5 Time-Saving Accounting Tips for Your Small Business

Source: ProductivityLand.com | Repost 10/24/2019 – Running a business is rewarding, but also insanely time-consuming. According to a 2015 Constant Contact survey, over 40% of small business owners say they don’t take vacations, while another 40% say they don’t have enough time to spend with their friends and family. Despite this, an overwhelming 84% of…

Read MoreIs it Necessary to Get an Accountant or Tax Preparer?

Accountants and other tax professionals can be worth their weight in gold during tax time, especially when it comes to legal and compliance issues. With the Income Tax Act numbering more than 3,000 pages, the amount of information often proves too much for the average business owner to stay on top of on their own.…

Read MoreAugust 2018 Update

Here’s what I’ve been up to… The next video training course is still in the works. It’s about Accounting fundamentals; Debits, Credits, Journal Entries, T-Accounts, the Basic Accounting Formula, etc. I’m really excited about this course as it will help a variety of folks. The intended audience is anyone new to Accounting or anyone that…

Read MoreJuly 2018 Update

Here’s what happened in July and some plans for August. In July, nearly 100 students enrolled in my new video training course 7 Ways to Improve your QuickBooks® Workflow! This is a great course if you’re new to QuickBooks® Online or want to learn some time-saving tips. Click the link below for more details. Students are…

Read MoreJune 2018 Update

Just wanted to share some news about what happened in June and plans for July. At the end of June my new video training course 7 Ways to Improve your QuickBooks® Workflow was completed and published! It’s nearly an hour in length and covers seven changes/techniques to improve your workflow in QuickBooks® Online Essentials or QuickBooks® Online…

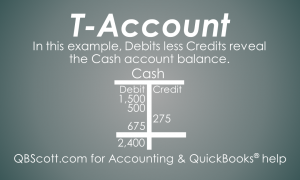

Read MoreT-Account Example

For the image below, total Debits less total Credits equal the Account Balance. So, in the example in the image, total Debits of 2,675 less total Credits of 275 equal 2,400. This is a Debit amount since, in this example, Debits are greater than Credits.

Read More