Posts Tagged ‘Financial Statements’

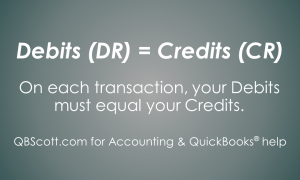

Debits = Credits

Debits must always equal Credits. On every transaction the total of the Debits must equal the total of the Credits. In some transactions you may have more than one Debit and only one Credit. Or you may have one Debit and more than one Credit. Regardless the total value of Debits must equal the total…

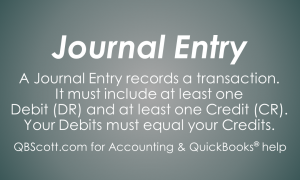

Read MoreWhat’s a Journal Entry?

The Journal Entry is used to record a transaction. It must include at least one Debit and least one Credit. The Debits and the Credits in the Journal Entry must equal. Journal Entries are used all throughout accounting.

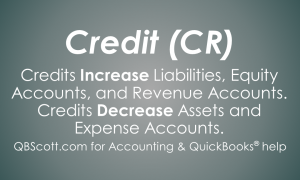

Read MoreCredits (CR)

Credits are the opposite of Debits. Credit increase Liabilities, Equity Accounts, and Revenue Accounts. They also decrease Assets and Expense Accounts.

Read MoreDebits (DR)

Learning about Debits (abbreviated DR) and Credits (abbreviated CR) can be confusing. However, if you keep in mind that Debits increase Asset and Expense accounts and decrease Liabilities, Equity Accounts, and Revenue Accounts, you’ll be half way there to understanding Debits and Credits.

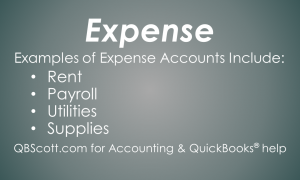

Read MoreExamples of Expenses

Expenses are what a company has incurred or used up and are shown on a Profit and Loss Report. Expenses can include Rent, Payroll, Utilities, and Supplies.

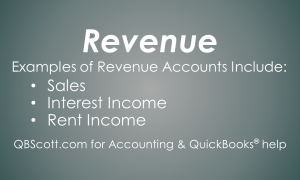

Read MoreExamples of Revenue

Revenue is what a company has earned and is shown on a Profit and Loss Report. Revenue can include Sales, Interest Income, and Rent Income.

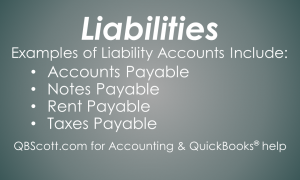

Read MoreExamples of Liabilities

Liabilities appear on a company’s Balance Sheet and are what the company owes. Liabilities can be Accounts Payable, Notes Payable, Payroll Payable, Rent Payable, Taxes Payable or any other payable.

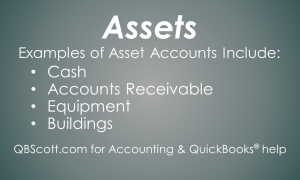

Read MoreExamples of Assets

Assets appear on a company’s Balance Sheet and are what the company owns. Assets can be Cash, Accounts Receivable, Equipment, Inventory, Land, Buildings, or even Intangible items.

Read MoreWhat is an Expense?

Expenses are what a company has incurred or used up. Expenses are shown on a Profit and Loss Report also known as an Income Statement.

Read MoreWhat is Revenue?

Revenue is what a company has earned. Sometimes this is referred to as Sales or Income. Revenue is shown on a Profit and Loss Report also known as an Income Statement.

Read More