How to Set a Vendor Record to be Eligible for a 1099 in QuickBooks Desktop

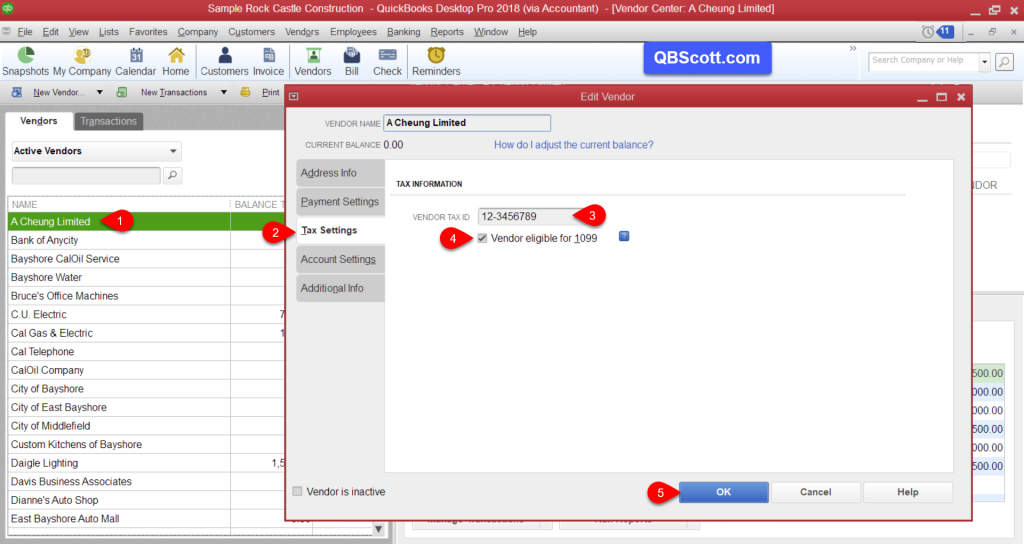

By default, QuickBooks sets each Vendor record to “Not eligible to receive a 1099.” So, if you have Vendors that may need to receive a 1099, you’ll have to set each Vendor record accordingly.

To set a Vendor to be eligible to receive a 1099, while in the Vendor Center double click on the Vendor (1), click the Tax Settings tab (2), confirm the proper Tax ID is in the Vendor Tax ID field (3), check the Vendor eligible for 1099 checkbox (4), and click the OK button (5).

Click on the screenshot below for a larger view.

Hope this helps!

Scott

More information like this can be found in my courses here.

Need help with your QuickBooks? I can help you! Click here for more info.